Redefining Finance for Good: COVID-19, a Catalyst for Inclusive Digital Finance

The current COVID-19 health crisis is unprecedented in its scope, impacting all countries and the world’s economy at large.

In banking, COVID-19 has accelerated the shift to digital, pushing customers towards mobile banking and contactless payments. For financial institutions, COVID-19 has acted as a catalyst for digital transformation, revealing how outdated current processes were and how badly they needed to change their value propositions.

As part of the “Redefining Finance for Good” series, we spoke to Lito Villanueva, Executive Vice President and Chief Innovation and Inclusion Officer at Rizal Commercial Banking Corp (RCBC), one of the top ten lenders in the Philippines. Villanueva discussed how COVID-19 has impacted RCBC and how the public health crisis has fast-tracked the development of inclusive digital finance solutions at the bank.

COVID-19: an opportunity for inclusive digital finance

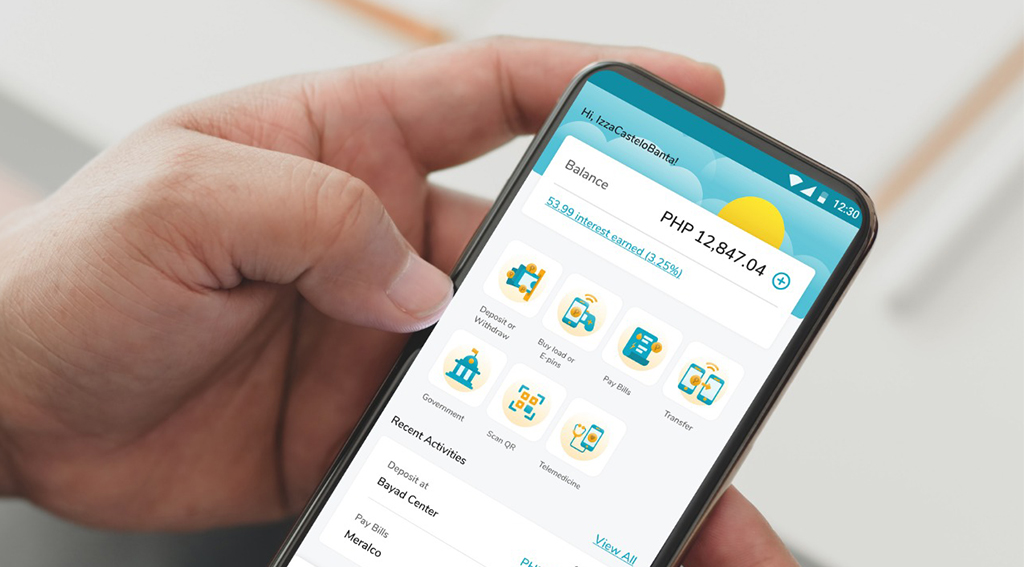

For RCBC, the pandemic and resulting rise in digital adoption has provided the bank with the opportunity to ramp up development of inclusive digital finance solutions. In July, RCBC launched the country’s first Taglish inclusion super app called DiskarTech (Taglish refers to the Filipino language Tagalog infused with American English).

DiskarTech aims to make banking services more accessible to the unbanked Filipinos nationwide, and services and capabilities such as digital transactions, insurance purchases, as well as the ability to open a bank account in less than three minutes using just a government ID and electronic know-your-customer (eKYC) methods.

People can also use the DiskarTech app to earn additional income by providing various “paki-suyo” services including bills payment, telco loading, purchase of gaming pins, facilitating money transfers, insurance purchases, and more. Those who can’t make the transactions themselves can ask these people to do them on their behalf, a sort of “transactions-on-behalf-of mode to cater to those who still do not have smartphones or have no data access,” Villanueva told Fintech News.

So far, reception of DiskarTech has been good, and the app is catching up fast with established competitors, Villanueva said, noting it had already gained numerous awards and accolades, including the Best Digital Bank award by Asiamoney and Alpha Southeast Asia, and was named the Most Innovative Internet Banking Service Provider in the Philippines by London-based financial publication The Global Economics Limited.

Another key initiative by RCBC has been the deployment of ATM Go terminals that partners with payment centers. ATM Go are the bank’s handheld ATM facilities that allows BancNet cardholders to make basic banking transactions like withdrawals, inquiry and fund transfers through any partner rural bank, drug stores, microfinance firms and even neighborhood “sari-sari stores” (neighborhood sundry shops).

These devices have served as disbursement platforms for government aid. Combined with DiskarTech, RCBC has facilitated the digital disbursement of more than PHP 9.2 billion (US$189 million) in government assistance to more than 2.4 million families or approximately 12 million individuals nationwide, Villanueva said.

As of June 2020, the bank had more than 1,800 mobile ATM terminals available in 72 out of 81 provinces across the country.

About 70% of the Philippines’ population are unbanked, Villanueva said, and the COVID-19 crisis has proven to be more severe for them compared to others. “We are talking about roughly 52 million adult Filipinos that do not have bank accounts … [Digital banking] will become the lifestyle of most people as we continue to advocate financial inclusion.”

Shifting to digital banking

For RCBC, COVID-19 has definitely accelerated the bank’s shift to digital, and it is now focused on further expanding its digital footprint nationwide, Villanueva said.

Amid the pandemic, RCBC has seen exponential growth in transaction value and volume across all its digital channels, “even reaching four-digit growth rate,” he said.

Customers are rapidly shifting to cash-lite transactions and preferring digital tools like financial apps and e-wallets as modes of payments, in addition to credit cards, he said, two trends that are “obvious indicators that majority of our clients and the public in general have quickly adopted to the digital and cashless transactions.”

“I don’t see any indications that we are going back to what we used to be in the near future,” he said. “We have to embrace this new normal and we have to adapt to it.”

Digital banking adoption will continue to grow post-COVID-19, Villanueva said, adding that government initiatives like the new national ID system will make it much easier for financial companies to onboard customers and will provide more seamless, digital-first user experiences.

Adjusting operations in times of a pandemic

Like in any other business and industry, COVID-19 has had a major impact of RCBC’s operations, forcing the bank to implement business continuity/contingency plans, and adhere to strict health and safety protocols.

“It was a big adjustment from the way we did things until the onslaught of the pandemic,” Villanueva said. “We have installed thermal scanners and disinfection at every entry point. Physical gatherings were eliminated and has shifted to virtual meetings. We have implemented a work from home scheme and just maintained a skeleton force in our offices and observed strict physical distancing protocols.”

Operations in physical branches have also been heavily disrupted, he added, with just a few selected ones remaining open.

This is part of our ongoing series of Redefining Finance for Good in partnership with Finastra, check out our other interviews with the industry’s top voices:

- Redefining Finance for Good: How DBS Responded to the Pandemic with Jeremy Soo, Head of Consumer Banking at DBS Bank

- Redefining Finance for Good: How the Pandemic Fast Tracked CIMB’s Digital Initiatives, with Samir Gupta, CEO of Group Consumer Banking at CIMB Group

- Redefining Finance For Good: Serving Asia’s 1 Billion Unbanked, with Wissam Khoury, Head of International, Finastra

- Redefining Finance for Good: Indonesia’s Largest Bank Reflects on the Future of Banking with Rico Usthavia Frans, IT and Operations Director at Bank Mandiri

- Redefining Finance for Good: HK’s Chong Hing Bank Sees Digital Shift for Older Customers, with Arthur Wong, CIO, Chong Hing Bank