PERA HUB introduces award-winning Digital Remittance Platform, giving businesses access to a global network of financial services

MANILA, Philippines—Remittances and digital transactions continue to grow this year, according to data from the Bangko Sentral ng Pilipinas (BSP)—signifying an opportunity for more streamlined financial processes and service providers.

According to the central bank, remittances from overseas Filipinos reached $3.24 billion from January to July 2022, a 2.3% increase from last year. The BSP also noted in the same period the combined value of transactions under PESONet and InstaPay at over P5.37 trillion, a 43% growth from 2021. While these could be attributed to the increase in the number of financial and remittance services, these also caused more problems specifically for businesses: the hassle of connecting with multiple networks and providers, as well as the inefficient and painstaking process to complete the integration.

Equipped with almost 25 years of expertise in the remittance industry, a well-established network through partnerships and over 3,500 physical locations across the country, PERA HUB is introducing its latest innovation as a solution: the Digital Remittance Platform or DRP.

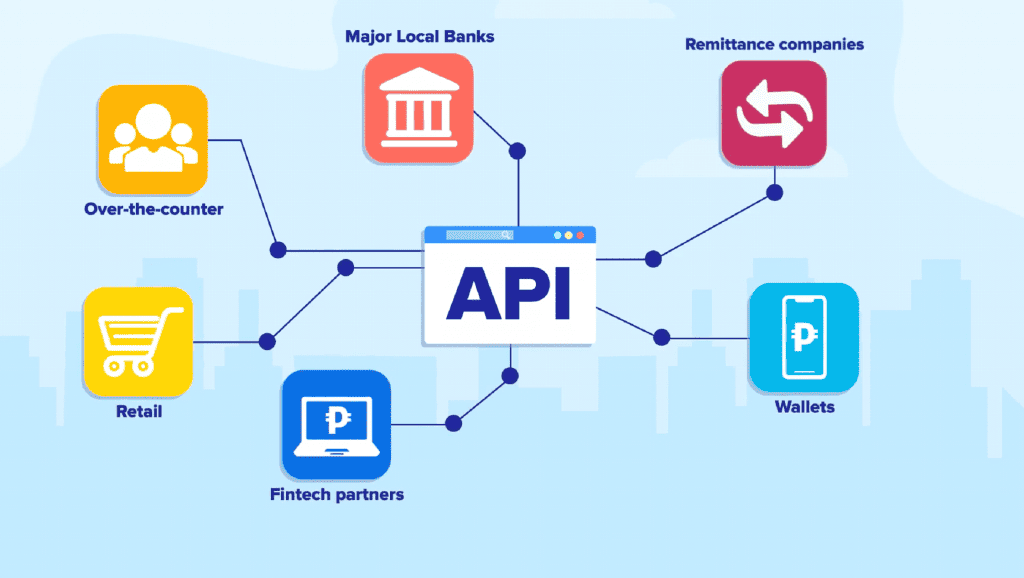

PERA HUB DRP is the first aggregated, single Application Programming Interface (API) platform in Southeast Asia that allows different businesses to integrate and connect to a network of retail and over-the-counter partners, major Philippine banks, remittance companies, digital wallets, and even emerging fintech. The platform, regulated by the BSP, is powered by a modern and secure API developer portal that enables access to PERA HUB’s network of financial services easily with an Open API standard.

“When talking about APIs and dealing with partners who are Banks, EMIs, or other financial service providers, it is crucial that we always ensure the security of transactions,” said Bryan Makasiar, PERA HUB Senior Assistant Vice President for Digital Business. “As a company, we were able to establish that capability plus accessibility and convenience through our infrastructure and people, to get the nod from the BSP.”

The DRP is best suited for financial services companies looking to increase their distribution channels quickly through PERA HUB’s physical network and digital community partners, as well as companies with digital communities aiming to provide reliable and scalable financial services.

This innovation is the recent recipient of the Asian Business Review’s Asian Technology Excellence Awards. For its “technological revolution and digital transformation”, PERA HUB DRP was given the Philippines Technology Excellence Award for Fintech–Remittance.

Ian Ocampo, President and CEO of PERA HUB, described the award as a “stepping stone” towards further innovation and explained the rationale behind the company’s establishment of the DRP.

“PERA HUB started in 1998 as a traditional brick and mortar remittance company and grew our network through partnerships with physical locations to expand our branch network. However, we recognized that we need to give our customers options on how they receive their money from their loved ones overseas and receiving it digitally is key to remain relevant in this business,” Ocampo said.

“PERA HUB saw the opportunity to leverage on our well-established partnerships to create a new platform that would enable businesses to connect to a network of remittance and other financial partners in one go. It opens an opportunity for them to easily integrate and expand their network to new customers by only connecting to one platform,” he added.

After over two decades, PERA HUB continues to improve its services for Filipinos, delivering exceptional convenience and choice while making money matters convenient. Aside from Western Union, PERA HUB DRP has also been fully integrated into other remittance providers such as Remitly, Uniteller, Japan Remit, Instant Cash, and Sendah Remit. It will be utilized as well in digital banking apps and fintech solutions like UnionBank, DiskarTech, and AllEasy. For more details, visit perahubdrp.com and like Pera Hub on Facebook for updates.

About PERA HUB

PERA HUB is the Philippines’ foremost consumer financial services center with over 3,000 locations composed of company-owned and PERA HUB Remit Partner locations nationwide. It provides its customers with a comprehensive scope of reliable financial services in one location. PERA HUB is geared towards providing complementary products such as remittance, cash in and cashout services, loans, money changing, bills payment, airline ticketing, e-loading, micro-insurance and other cash and payment related solutions to its growing market.

To further leverage on new technologies, PERA HUB launched their own app and their PERA HUB Visa Prepaid Card to allow 24/7 access to financial services. In 2021, PERA HUB launched the PERA HUB Digital Remittance Platform (DRP), Southeast Asia’s first API Developer portal for remittances to empower the next generation of fintech solutions. The platform serves foreign and local remittance companies, fintech partners, banks, ewallets, brick-and-mortar retailers, and any other business looking to offer their customers world-class digital remittance services. The open and cost-efficient platform, provides remittance brands with safe & scalable solutions and is poised to offer other financial services on the portal such as payments & insurance. The PERA HUB Digital Remittance Platform was recognized by the Asian Technology Excellence Awards and won the Philippines Technology Excellence Award for Fintech – Remittance in 2022.

For your cash and payment-related solutions, visit PERA HUB branches nationwide or download the PERA HUB App in Google Play and App Store. Call us at (+632) 8-7372482, and follow perahubph on Facebook and perahub on Instagram. You can also Sign up for free and get early access to PERA HUB’s Developer Portal and PERA HUB’s API system.

ABOUT PETNET

PETNET is geared towards providing financial services to consumers and businesses. Initially established to grow the network of Western Union in the Philippines, the company grew its portfolio and embarked on a massive branch and service offering expansion program through its retail network PERA HUB. Its corporate arm, PETNET Forex Solutions, provides accessible, convenient and efficient forex solutions via buying and selling of USD and cross-border B2B payments.

PETNET is majority-owned by City Savings Bank, Inc. and Union Properties, Inc., both wholly-owned subsidiaries of Union Bank of the Philippines (UnionBank), the financial services strategic business unit of publicly-listed company Aboitiz Equity Ventures, Inc.